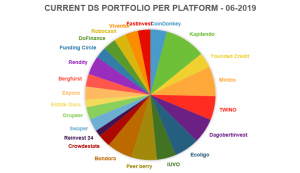

Holdings on 30/06/2019:

– ReaCapital:

LO9 – City Apartments received € 2000 at 5,25 % p.a. (+0,5% p.a. bonus) from November 3rd 2017. €2207,67 repaid on June 20th 2019, with final interest rates totalling 6,38% p.a. – DS is interested in investing with ReaCapital again, but no projects are currently available.

– CoinDonkey:

1 MS bought for € 990 on 27/11/2017 – repayment averaged € 16-20 in first 6-8 months. Change to system linked MS value to Crypto rates, so this investment lost considerably towards the end of 2018 but has recovered during 2019. Since June has a current value above original investment.

– Kapilendo Portfolio:

Prosenio received € 500 at 7% p.a. (+ <= 20% bonus) from 01/03/2018 – yearly interests and repayment at end of three years;

NanoFocus received € 500 at 7,5% p.a. (+ up to =20% bonus) from 17/04/2018 – yearly interests and repayment at end of four years;

Dual received € 500 at 8,5% p.a. (+ up to 25% bonus) from 03/04/2018 – yearly interests and repayment at the end of five years;

Arend received € 500 at 8% p.a. (+ up to 20% bonus) from 15/05/2018 – yearly interests and repayment at the end of four years;

#Do your sports received € 1000 at 7,9% p.a. (+ 3% cashback for platform’s birthday) from 18/07/2018 – quarterly interests and repayment at the end of three years. Started repaying in 2018;

Mandrops AG received €500 at 10,10% p.a. from 21/07/2019 – quarterly interests from October 2019 and quarterly repayment from April 2021.

– Mintos Portfolio:

Second-tier platform with many crowd-lending providers in multiple countries. First € 1000 investment where we chose project, second € 1500 investment was followed by Auto-invest being set up and a fraction was allocated to their Invest & Access functionality, which should have immediate liquidity. Until end of June 19, yearly returns averaged 10,49%. Withdrawal of €200 towards the end of 2018, easy after KYC routine, was already fully repaid with interests from the platform.

– Younited Credit:

€ 2000 originally invested across their different funds. FinTech has since closed some funds and automatically selling investor’s shares, with DS’ exposure therefore reduced to around € 1200 and getting a little interest accrue over that.

– TWINO:

Crowd-lending platform with European and Eastern European credits to individuals, with high yields but credits seem to be catching up in volume to the investments available in the platform. Invested € 2000 to test the platform, half of which allocated to auto-invest, averaging 9,70% p.a. Withdrew €150 easily towards the end of 2018, and accrued interest by July 2019 compensated this first withdrawal.

– DagobertInvest:

P155 – Future Living – Goldenes Ottakring received €1000 at 7% p.a. for 18 months from 30/08/2018;

P152 – Kaiserstraße 34 – received €1000 at 6,85% p.a. for 20 months from 12/09/2018;

P197 – PAUL&PARTNER: Adonisweg Wien-Donaustadt – received €500 at 7,45% for 24 months from 27/06/2019.

– Ecoligo:

€1000 for 50 kWp Solaranlage – Live Wire Wasserversorgung – 5,5% annual interests plus 0,5% early bird bonus with 5 year tenor. Repayment starts towards the end of January 2019;

€1000 for 71 kWp Solaranlage – Casa Luna Bungalows – 5,0 % pa plus 0,5% early bird over 6 years. Interest repayment starts on October 2019.

– IUVO:

€900 allocated on 21/11/2018 to auto-invest with buyback guaranteed current loans originally averaging over 10% yearly interests;

€600 added to the account on 17/06/2019, current average interest rates are 12,41%.

– PeerBerry:

€1000 allocated on 05/12/2018 to an auto-invest portfolio in guaranteed current loans; €1000 added to the account on 21/06/2019 – portfolio averaging 11,56%.

– Bondora:

€500 in auto-invest to better than E rating loans on 17/01/2019. Average interest rate was 19,8%; €500 added to the auto-invest account on 03/05/2019; another €1000 added on 24/06/2019 to Go&Grow segment, with immediate liquidity. Current net return is 21,13%.

– Crowdestate:

€500 invested mostly on secondary market deals on 17/01/2019. €500 added on 17/06/2019 to primary and secondary markets. Average expected returns are 13,71% p.a. and value has been positive since a short period after first investment.

– Reinvest24:

€200 invested in two real estate projects from 18/02/2019. Added €300 to another three projects on 18/06/2019. Other than the fee per investment, not much movement in our account so far, but expected returns are decent.

– Swaper:

€500 invested on 21/02/2019 and another €500 added on 17/06/2019 to a broad auto-invest portfolio returning 9,32% p.a. XIRR.

– Grupeer:

€500 invested through auto-invest on 16/03/2019 and €500 added on 17/06/2019 in loans ranging from 10-13% annual interests.

– EstateGuru:

€300 invested equally in three different projects on 26/03/2019 and repeated the same investment on 26/06/2019. Expected returns are over 10% yearly.

– Exporo:

€500 invested on Wohnen in Nastätten with 25 month period and 6% interest from 26/03/2019. Exporo offered a bonus for first time investors topping up my investment with an extra €50;

€500 on Portfolio NRW II with 34 months and 5,5% interests from 17/06/2019.

– Bergfürst:

€500 on Bellavista 71 Mallorca with 12-36 months and 7,0% annual interest rates from 08/05/2019; €500 on Kitzbühel with 12-48 months and 7,5% annual interest rates from 17/06/2019. Interest rates are paid twice a year in June and December, we were already credited with the proportional first period.

– Rendity:

€1000 on Mayssengasse 22 on 08/05/2019 for 24 months and 6,75% annual interest rates; €500 on Huflattichweg 4 on 24/06/2019 for 24 months and 6,5% annual interest rates.

– Funding Circle:

€1000 allocated from June to a number of different projects with average interest rates of 10,09%.

– DoFinance:

€1000 allocated on 21/06/2019 to an auto-invest 11% portfolio.

– Robocash:

€1000 to an auto-invest portfolio on 26/06/2019 with interest rates between 11-15%.

– Viventor:

€1000 to an auto-invest portfolio on 26/06/2019 with interest rates between 8-16%, mostly allocated to consumer credit.

– Fastinvest:

€1000 to an auto-invest portfolio on 27/06/2019 with interest rates between 9,0-16,0%.

– Lendermarket:

€1000 allocated to an auto-invest portfolio averaging 12% interest per year.

Total:

€ 33.304,04 current portfolio value (expected annual return under review*).