We now have a few different platforms to present, so we should get right to it with Bergfürst.

Bergfürst strengths

- Without such a large project pipeline as others, we still haven’t seen this FinTech run out of open projects ready to receive investment;

- Projects have so far been in varied geographical locations in at least three countries, avoiding single-market risks;

- Interestingly, this platform has an arm of the giant Commerzbank as an investor. Even though Berfürst still works as an independent Startup, having a larger organisation behind them possibly enhances credibility, hence their pride in advertising it;

- Acceptance of DS as a company investor was not as simple and 100% online as with other platforms, but was at least feasible and clearly communicated. We needed to fill in a paper form and send by post. However, considering that we generally expect much less of such offline procedures, it ran quite smoothly;

- As much as I haven’t tested it myself, there seems to be a possibility to do a plan with a monthly investment of as little as 10 € and build it up over time. This is a feature we haven’t seen in other real estate FinTechs;

- Theoretically the platform offers a secondary market where investors can sell their stakes in Bergfürst’s projects. We still didn’t get to test it, but it seems like an interesting functionality.

- Their referral programme seems to get a bonus to both ends of investors, so feel free to use our code here.

Where the FinTech could do better

· As usual with real estate projects, investors are only expected to get their income every six months and principal amount at the end of projects, which means little liquidity. This FinTechs advertises a secondary market facility, but having invested two months ago we still haven’t had access to that, so pending on verifying how well that works;

· An important side effect of their big corporate affiliation, Bergfürst is unlikely to work to disrupt finance. The company will probably want to stay within market parameters, which is on one hand acceptable. We are on the other hand advocates for change in the financial industry. As such, we consider still to be seen if a bank-backed Startup can actually promote change in the industry;

· It’s still unclear what the company is working on next. Many FinTechs keep their programmers busy and investors like us are eager to see what they come up with next. Bergfürst seems to have a more traditional approach, a nice-looking website but without much hint to their future moves.

Financials

· Initial investment amount of 500 Euros, plus 10€ bonus, allocated to project Kitzbühel; Interest rate of 7,5 % p.a. and tenor of 36 months;

· Second investment of 500 Euros offered for project Bellavista 71 Mallorca; Interest rate of 7,0 % p.a. and tenor of 34 months.

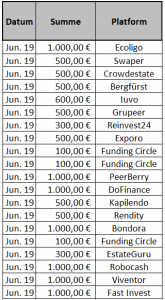

Last month, we’ve had a run of new investments much faster than our usual gradual platform test. While further detail of each investment will come in due course, we wanted at least to give you a quick overview of allocated funds.

This makes us – as far as we could find online – the largest open FinTech portfolio in Europe! DS currently holds over 31.000,00 € invested in our FinTech portfolio, and still growing.

Keep coming back for more FinTech and entrepreneurship.